Understanding wealth inequality in the US: Insights from Pew Research

In the wake of the Great Recession, the United States experienced profound economic changes that have had lasting effects on the distribution of wealth.

Recent research from Pew Research sheds light on the extent of wealth inequality in the US, highlighting disparities across racial, ethnic and income lines.

In this article, we examine the key findings and implications of this research, exploring the factors that contribute to wealth inequality and potential avenues for addressing these disparities.

The Great Recession

The Great Recession was a severe global economic downturn that lasted from late 2007 to approximately 2009. It had far-reaching ramifications across nations, particularly impacting the United States.

The recession was defined by a pervasive financial crisis, plummeting economic productivity, and soaring unemployment figures. This recession left enduring imprints on the US economy.

Financial institutions faced unprecedented strains, triggering a cascade of bank failures and corporate collapses. The housing market crashed during the subprime mortgage crisis, causing many homeowners to owe more than their homes were worth.

This worsened the economic turmoil, leading governments to implement large stimulus packages and intervene in financial markets. The labor market was hit hard, resulting in millions of Americans losing their jobs and facing prolonged unemployment.

Consumer confidence dropped, causing significant decreases in spending and investment. The Great Recession prompted policymakers to reevaluate regulatory frameworks and economic policies, striving to strengthen economies against future shocks while grappling with the lasting scars left by the crisis.

Racial and ethnic disparities in wealth inequality

One of the most striking findings from the Pew Research data is the significant wealth gap along racial and ethnic lines. White households have a median net worth 10 times that of black households and 8 times that of Hispanic households.

Moreover, since the recession, the median net worth of white households has risen by 14 per cent, while it has fallen by 34 per cent for black households and 15 per cent for Hispanic households.

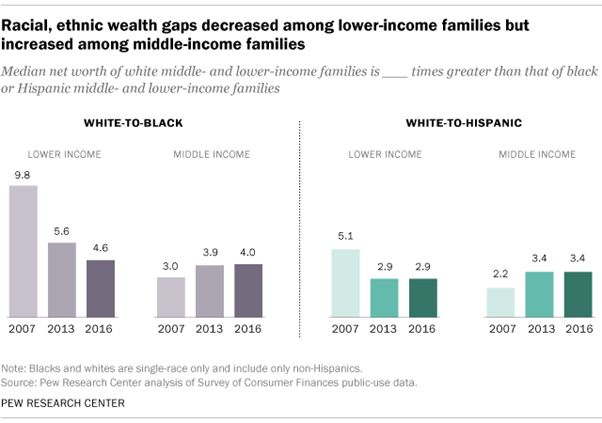

During the recession, middle-income black and Hispanic households experienced significant declines in median wealth. In 2013, the median wealth of middle-income black families had plummeted by 47% to $33,600, while that of middle-income Hispanic families had fallen by 55% to $38,900.

In contrast, middle-income white families saw a smaller decrease of 31%, with their median wealth dropping to $131,900.

During or after the recession, racial and ethnic disparities in wealth among middle-income families widened. The white-to-black wealth ratio rose from three-to-one to four-to-one from 2007 to 2013, and the white-to-Hispanic wealth ratio increased from two-to-one to three-to-one, persisting through 2016. These trends highlight the ongoing challenges of wealth inequality faced by minority communities.

Factors contributing to wealth inequality

Pew Research has highlighted various factors that influence wealth inequality in the United States. One crucial determinant is the variance in housing wealth among different demographic groups. Fluctuations in property values have a substantial impact on overall wealth distribution, disproportionately affecting those with less access to homeownership and less stable housing markets.

Income inequality is another key contributor to wealth disparities. Higher-income individuals and households have a greater capacity to save and invest, which increases their wealth over time. In contrast, those with lower incomes often struggle to cover basic expenses, let alone accumulate savings or investments that could contribute to wealth accumulation.

Additionally, savings and debt levels significantly contribute to wealth inequality. Some people and families can save and accumulate assets, while others struggle with debt, especially from student loans, credit cards, or medical bills. Excessive debt can hinder opportunities to build wealth and perpetuate economic inequalities.

In general, these interrelated factors create a complicated web of inequality that reinforces wealth disparities among different races, ethnicities, and socioeconomic groups. Comprehensive policies are necessary to address wealth inequality. These policies should tackle the root causes and provide opportunities for individuals and families to build and preserve wealth over time.

Tackling wealth inequality

To reduce wealth inequality and its social impact, it is crucial to address the systemic factors that perpetuate inequality.

Access to education, employment opportunities and home ownership are key areas that can help level the playing field and promote greater economic justice. Policies aimed at reducing wealth inequalities, particularly for racial and ethnic minority groups, are essential to building a fairer society.

Pew Research's findings underscore the urgent need to address wealth inequality in the United States. By understanding the factors that contribute to inequality and implementing targeted policies and interventions, we can work toward a future in which everyone has an equal opportunity to thrive and prosper.

Only through collective action and commitment to social and economic justice can we truly achieve a fairer society for all.

Source: Pew Research Center

nspired to make a difference? Join V4H and Take Action: learn more about our programs, our volunteering opportunities, and how you can advocate for a brighter future.

Together, we can reach for the stars and make the impossible, possible.